Neither the precision of software information nor the suitability of the plan for the predicament are certain. The search results displayed shouldn't be considered an exhaustive listing of grants Which might be obtainable for you. Speak with a Chase Home Lending Advisor for more particular information and facts or to study further programs.

An FHA cash-out refinance enables suitable homeowners to refinance their present home loan for a larger loan than they now have and obtain the real difference for a lump sum of cash.

Home fairness conversion house loan (HECM): The HECM is usually a reverse property finance loan insured by The federal government which allows Individuals over the age of 62 to faucet the equity within their home. This equity acts like a source of money. On the other hand, if the borrower dies or moves out with the home, the mortgage loan need to be compensated again.

In exactly the same way as regular home loans, fascination prices are ruled by industry forces. Very like Texas USDA loans and VA loans in Texas, the underwriting and writing a home loan are the main distinctions in between common loans and FHA mortgages.

Income and work is an eligibility Think about regard to FHA loans. Lenders have to have that a borrower can clearly show evidence of continual work with “productive cash flow.”

Reflecting on our journey, we’ve traversed extensive prairies of information, from comprehending FHA loan requirements in Texas to cracking down around the application method. We’ve explored the backroads of eligibility procedures and in fha in texas some cases detoured to check FHA loans PA.

With above two several years of encounter composing within the housing market place space, Robin Rothstein demystifies property finance loan and loan concepts, aiding first-time homebuyers and homeowners make informed choices as they navigate the home loan marketplace.

“Pro verified” ensures that our Money Assessment Board thoroughly evaluated the post for precision and clarity. The Assessment Board comprises a panel of economic authorities whose goal is making sure that our material is often aim and well balanced.

When This system restarts, to become a complete participant in This system, it's essential to productively full a trial payment strategy wherein you make three scheduled payments—on time—within the lessen, modified sum.

Bear in mind that you simply’ll have to invest in personal house loan coverage In case your deposit is below 20%.

An FHA loan is usually a form of property finance loan geared toward borrowers with decreased credit scores, or who in any other case don’t qualify for a traditional loan.

Borrowers can use present resources from relations, businesses, or charitable businesses to include the deposit and closing prices.

g., an increase in the speed index in between the time of prequalification and some time of application or loan closing. (Or, When the loan choice is often a variable level loan, then the fascination charge index used to established the APR is subject to raises or decreases Anytime). Lenders reserve the correct to vary or withdraw the prequalified rates at any time.

Account icon An icon in The form of anyone's head and shoulders. It typically signifies a person profile. Bounce TO Segment Chevron icon It signifies an expandable portion or menu, or at times previous / upcoming navigation choices.

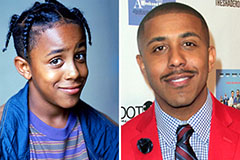

Marques Houston Then & Now!

Marques Houston Then & Now! Traci Lords Then & Now!

Traci Lords Then & Now! Tonya Harding Then & Now!

Tonya Harding Then & Now! Barbara Eden Then & Now!

Barbara Eden Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now!